How to Extract Liquidity from Relinquished Property While Deferring Taxes with a 1031 Exchange.

Often owners of investment real estate find themselves in situations in which they are “property rich and cash poor.” Thus, when contemplating a tax-deferred 1031 exchange owners often ask about ways to “unlock” equity in their property and receive a cash distribution from the exchange proceeds while still deferring tax. Interest in this topic is entirely understandable. Unfortunately, the IRS is rather explicit in the treatment of cash or “boot” received as a result of an exchange. In fact, not only is all “boot” taxable, it is “taxed first,” making it subject to the highest applicable tax rate, including: Depreciation Recapture, Capital Gains Tax, State Taxes (if applicable), and the Affordable Care Act Tax. Needless to say, the penalty on “boot” is severe, thus ensuring all exchanged equity and debt qualifies for tax-deferment is of the utmost importance.

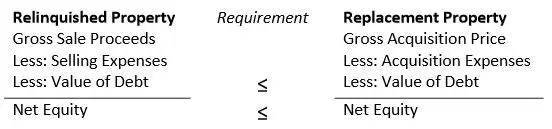

Many investors are under the impression that in order to avoid “boot” qualified replacement property(s) must have equal or greater debt and equal or greater equity. While adhering to this guideline would satisfy the exchange criteria, it is an oversimplification. Instead, investors must ensure that the “Net Equity” from the relinquished property is equal or greater in the relinquished property and that the value from the debt in the relinquished property is equal or greater in the replacement property. The value of the debt that needs to be matched or exceeded does not need to be matched by debt, instead it can be matched by cash or non-traditional debt such as seller-financing, an outside loan or a combination of. Essentially, without creating “boot,” you cannot take a reduction in overall value (Net Equity + Value of Debt) when moving from relinquished to replacement property as displayed below:

Understanding how to avoid “boot” is key to ensuring an investor’s exchange is entirely tax-deferred. Tax-deferred liquidity is not possible at the time of an exchange; however, it is possible either before or after an exchange – depending on the relinquished and replacement property profiles.

Owners looking for liquidity have a number of available options. Owners can refinance their property in advance of the sale to extract equity from the property. While a reduction in equity and a corresponding increase in the property’s loan-to-value (LTV) may change the replacement property options, it does not eliminate either the fee-simple or Delaware Statutory Trusts (DSTs) as viable replacement property(s) as both can be purchased with moderate to high LTVs. Furthermore, high LTV Delaware Statutory Trusts can be used to account for the replacement debt, leaving residual equity to be exchanged into more conventional 50% LTV fee-simple or DST property. It should be noted that properties that are refinanced in advance of a pending sale and subsequent exchange should be refinanced with sufficient time before the sale so that the IRS is not led to believe that the refinancing was done solely with the intent of extracting capital from the property. What constitutes sufficient time is a conversation to be had with your tax advisor, however many professionals suggest either the refinance and sale occur in separate tax years or a calendar year fall between the two.

The other option for extracting capital is to refinance the replacement property following the exchange. Traditionally, the IRS has not contested refinancing following an exchange, thus they can occur any time after the replacement property is closed on. However, financing should not occur simultaneous to closing on the replacement property.

At Real Estate Transition Solutions, we understand there are a number of objectives that must be considered and balanced when evaluating transition options – including liquidity needs. Do not hesitate to contact us if you have any questions regarding your objectives and how they might be best achieved.

If you have an issue or a concern relating to your investment property ownership, contact Austin Bowlin, CPA and Partner at Real Estate Transition Solutions to schedule a complimentary consultation. Austin provides exit strategy analysis, execution, income and equity replacement options for investment property owners and can be reached at 206-686-2201 or email him at aabowlin@re-transition.com.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options