Understanding a 721 Exchange (UpREIT)

- By Austin Bowlin, CPA

- Update: October 10, 2024

Table of Contents

A 721 Exchange, also known as an UpREIT, enables institutional property owners to contribute their investment property to a Real Estate Investment Trust (REIT), deferring capital gains taxes while gaining access to REIT benefits. Unlike a 1031 Exchange, which involves swapping one property for another “like-kind” property, a 721 Exchange allows property owners to exchange real estate for Operating Partnership (OP) units. These units provide benefits similar to REIT shares, such as passive income through distributions, diversification across a professionally managed portfolio, and potential liquidity through access to public markets.

OP units represent equity ownership in the REIT’s operating partnership, which directly holds and manages the real estate portfolio. While distinct from REIT shares, OP units are often convertible to REIT shares on a 1:1 basis after a specified holding period, offering enhanced flexibility. This makes 721 Exchanges an attractive option for property owners seeking to reduce management responsibilities, diversify their investments, and retain tax advantages.

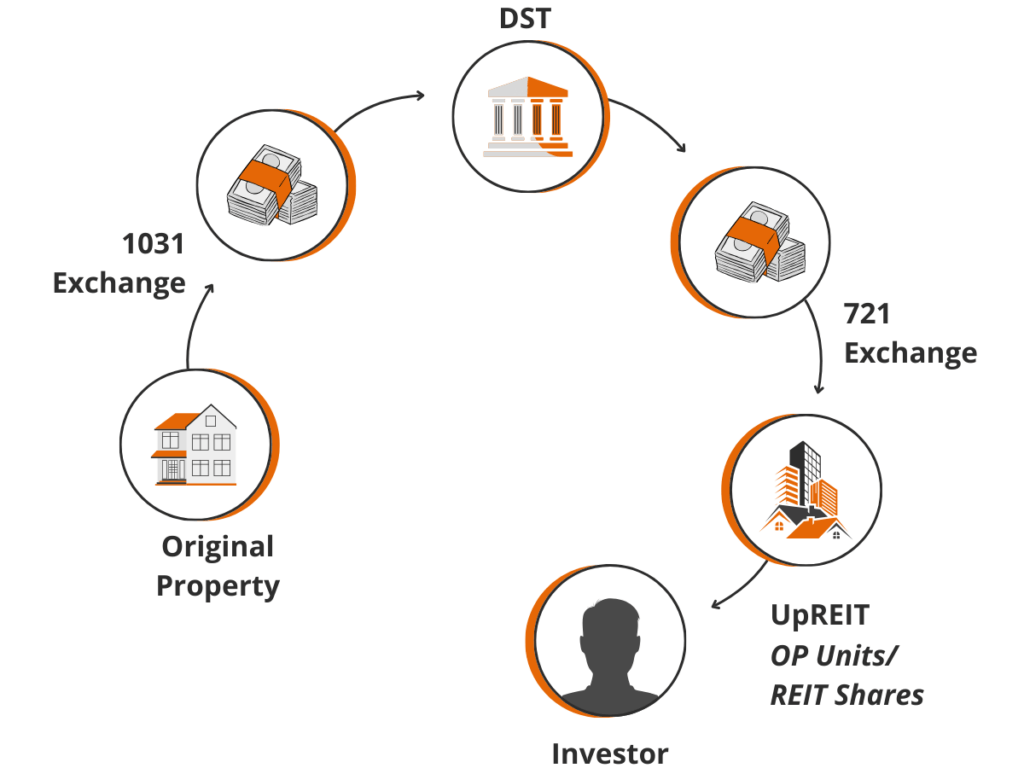

For non-institutional property owners, the path to a 721 Exchange typically involves a two-step process. First, they use a 1031 Exchange to reinvest proceeds from a property sale into a Delaware Statutory Trust (DST), which owns institutional-grade real estate. Once the DST reaches the end of its investment cycle or “goes full cycle,” its assets can be contributed to a REIT through a 721 Exchange in exchange for OP units. This strategy completes the transition from active property management to REIT participation, all while keeping tax deferral intact.

What is a 721 UpREIT?

Similar to a 1031 Exchange, a 721 Exchange or UpREIT (Umbrella Partnership Real Estate Investment Trust) allows the owner of institutional grade property—property of sufficient size and stature to merit attention from large national or international investors—to defer capital gains taxes that would otherwise be due upon the sale of their property. Instead of a sale that would create a taxable event, owners contribute their property to a REIT and receive Operating Partnership (OP) units in return, deferring tax until the owners sell the OP units.

Once their property is contributed to the REIT, the OP units generate dividend income derived from the rental income and operations of the REIT’s portfolio. Typically, OP units mirror the REIT shares distribution rates and value. The distinction between the OP units and REIT shares is the embedded tax deferral within the OP units. Ownership of OP units provides a steady stream of passive income. By contributing property to a REIT, owners gain access to a diversified portfolio of real estate holdings, rather than being tied to a single asset.

Additionally, REITs typically offer greater liquidity compared to direct property ownership. While real estate can take time to sell, OP units can be converted into more liquid REIT shares. The act of converting OP units into REIT shares triggers the deferred tax liability to be due. As such, investors typically do not convert OP units into shares until they either intend to sell the shares or once they recognize a step-up in basis. In public REITs, shares can be bought and sold on a continuous basis, providing even greater flexibility.

Qualifying Properties for a 721 Exchange

Not all properties are candidates for a direct 721 Exchange. Typically, a property must be institutional grade, meaning the property is of sufficient size and quality to attract large domestic or international investors. Common examples of institutional-grade properties include large class A multifamily complexes, net lease retail buildings, industrial facilities and distribution centers, and various other types of higher-value commercial real estate.

However, sub-institutional real estate owners who do not own institutional-grade properties can still participate in a 721 Exchange via a Delaware Statutory Trust (DST). Utilizing a 1031 Exchange, they can invest in a DST that holds institutional-grade properties specifically intended to participate in an UpREIT exit. The fractional ownership of a DST opens the door to a future 721 Exchange when the REIT acquires the DST property.

1031 Exchange vs. 721 UpREIT

A 1031 exchange and a 721 exchange both enable investors to defer capital gains taxes when selling investment properties, but they differ in the type of properties involved, timelines, and goals.

- Type of Relinquished Property: A 1031 exchange typically involves sub-institutional properties, such as single-family rentals or small apartment buildings, exchanged for like-kind real estate. A 721 exchange involves contributing institutional-grade properties, such as large commercial or multifamily assets, to a Real Estate Investment Trust (REIT). Investors receive REIT equity units instead of direct ownership.

- Exchange Timeline: A 1031 exchange follows a strict IRS timeline: 45 days to identify replacement properties and 180 days to complete the exchange. A 721 exchange offers more flexibility, with no fixed deadlines for contributions to a REIT.

- Type of Replacement Property: In a 1031 exchange, investors retain direct ownership of replacement properties, including fee-simple, tenant-in-common (TIC), or Delaware Statutory Trust (DST) structures. A 721 exchange transitions ownership into REIT equity or Operating Partnership (OP) units, offering stakes in a diversified institutional portfolio rather than specific property ownership.

- Tax Implications: Both defer capital gains taxes, but 1031 exchanges pass the deferred liability to the new property. In 721 exchanges, taxes are deferred until REIT shares are sold, potentially at higher rates.

While DST properties can be contributed to a REIT via a 721 exchange, DSTs already provide fractional ownership of institutional-grade properties, often meeting investors’ diversification and passive income goals without requiring a REIT transition.

These distinctions demonstrate how 1031 and 721 exchanges serve different investor needs and can work together as part of a broader investment strategy.

Defer Capital Gains Tax with a 721 UpREIT

721 UpREIT Pros & Cons

Exchanging fee-simple property for interest in a REIT has several potential benefits and important considerations to keep in mind.

Benefits of a 721 Exchange

- Tax Deferral: Like a 1031 Exchange, the 721 Exchange allows investors to defer capital gains taxes associated with selling property.

- Passive Income: REITs provide dividend income to shareholders, often with tax advantages such as depreciation and Qualified Business Income (QBI) deductions.

- Increased Liquidity: REIT shares or OP units offer more liquidity than directly held real estate, providing more flexibility for individual investors.

- Tax-Free Liquidity: REIT shares can be sold to the extent of the carryover basis in the shares without triggering a tax liability.

- Diversification: REITs typically hold diverse property portfolios, serving to mitigate the risk of investing in a single property.

- Perpetual Investment: REITs are structured to allow long-term ownership without the need to perform future 1031 Exchanges.

- Tax Elimination: Ownership in a REIT can benefit from a step-up in basis at death, eliminating deferred taxes.

- Estate Planning: 721 Exchanges are useful for transitioning assets to beneficiaries. REIT shares are divisible, simplifying inheritance plans. The 721 UpREIT is often used as the final exchange in a series of deferred transactions.

Tax Deferral

Like a 1031 Exchange, the 721 Exchange allows investors to defer capital gains taxes associated with selling property.

Passive Income

REITs provide dividend income to shareholders, often with tax advantages such as depreciation and Qualified Business Income (QBI) deductions.

Increased Liquidity

REIT shares or OP units offer more liquidity than directly held real estate, providing more flexibility for individual investors.

Tax-Free Liquidity

REIT shares can be sold to the extent of the carryover basis in the shares without triggering a tax liability.

Diversification

REITs typically hold diverse property portfolios, serving to mitigate the risk of investing in a single property.

Perpetual Investment

REITs are structured to allow long-term ownership without the need to perform future 1031 Exchanges.

Tax Elimination

Ownership in a REIT can benefit from a step-up in basis at death, eliminating deferred taxes.

Estate Planning

721 Exchanges are useful for transitioning assets to beneficiaries. REIT shares are divisible, simplifying inheritance plans. The 721 UpREIT is often used as the final exchange in a series of deferred transactions.

Considerations of a 721 Exchange

- Loss of Future 1031 Exchange Optionality: Once ownership is converted into REIT shares, future 1031 Exchange eligibility is lost. Selling shares before a step-up in basis beyond the value attributed to carryover basis will typically be treated as taxable.

- Complexity: The 721 UpREIT process can be complex, requiring tax planning and professional guidance from advisors specializing in 1031 Exchanges, replacement property options and REIT structures.

- Due Diligence: REIT managers have the ability to actively manage the composition of the REIT portfolio, buying and selling real estate within the portfolio as they see fit. Sponsor-level and property-level due diligence is critical given REIT manager’s management authority.

Loss of 1031 Exchange Optionality

Once ownership is converted into REIT shares, future 1031 Exchange eligibility is lost. Selling shares before a step-up in basis beyond the value attributed to carryover basis will typically be treated as taxable.

Complexity

The 721 UpREIT process can be complex, requiring tax planning and professional guidance from advisors specializing in 1031 Exchanges, replacement property options and REIT structures.

Due Diligence

REIT managers have the ability to actively manage the composition of the REIT portfolio, buying and selling real estate within the portfolio as they see fit. Sponsor-level and property-level due diligence is critical given REIT manager’s management authority.

DST Conversion to REIT

How a DST Property Converts to REIT Ownership

For sub-institutional property owners, the path to a 721 Exchange often begins with a 1031 Exchange into a DST property. By owning a fractional interest in institutional-grade properties, individual exchangers can access the benefits of high-quality real estate without the responsibility of managing it directly.

Once the DST property is absorbed by a REIT, exchangers’ interests convert into OP units in the REIT, completing the 721 UpREIT process. Once an investor is ready to sell their REIT ownership or a step-up in basis is realized, thus eliminating the deferred tax liability, OP units are converted into REIT shares. This strategy offers a unique way to defer taxes, diversify a real estate portfolio, and transition from active management to passive income.

By integrating 1031 Exchanges, DSTs, and 721 UpREITs, investment property owners can transition their active property ownership into REIT ownership on a tax-deferred basis. The steps required to execute this transition are as follows:

From 1031 Exchange to 721 UpREIT

Step 1 - Investor Sells Fee Simple Property with 1031 Exchange

Sub-institutional investment property owners can defer the taxes due on a sale (including capital gains, depreciation recapture, and state income taxes) by completing a 1031 Exchange and reinvesting their sales proceeds into DSTs intended to be converted into a REIT via 721 UpREIT.

Step 2 - Investor Selects 1031 DST Property Intended for REIT Conversion

As institutional-grade properties, DSTs are attractive to REITs, making UpREITs possible at this stage. Some DSTs are designed with the specific intention of being absorbed by pre-determined REITs.

Step 3 - DST Property Absorbed by REIT

Once a DST is absorbed by a REIT, fractional interests in the DST are exchanged for Operating Partnership (OP) units in the REIT. OP units participate in the REIT’s income and asset appreciation in the same way REIT shares do. When an owner is ready to sell their ownership, the OP units can be converted into REIT shares.

Step 4 - Investor Converts OP Units to REIT Shares

OP units are eventually converted into REIT shares, providing investors with liquidity. The conversion to REIT shares itself is a taxable event, thus owners typically do not convert their OP units to REIT shares until they plan to either liquidate their shares or have received a step-up in basis whereby the deferred tax liability has been eliminated.

Hardwired vs Hybrid UpREITS

UpREIT DSTs generally fall into two categories: Hardwired and Hybrid UpREITS.

- Hardwired UpREITs: Typically, these DSTs have a fixed holding period of two to three years. After which, all investors whom exchanged into the DST must participate in the UpREIT transaction, converting their DST interests into OP units.

- Hybrid UpREITs: Hybrid structures offer more flexibility, with a typical hold period of two to five years. Investors can choose a cash purchase offer, enabling them to perform another 1031 Exchange or pay tax. Investors who opt not to receive cash proceeds are absorbed into the REIT.

Examples of DST Properties designed for REIT Conversion

To illustrate how the 721 exchange can be applied in real-world investment scenarios, consider two recently funded DST offerings that are positioned for conversion into Real Estate Investment Trusts (REITs) through an UpREIT strategy.

Hines HREX Multifamily II DST, structured as a hardwired UpREIT, is designed with a predetermined path to REIT conversion, offering investors a streamlined transition into a diversified institutional portfolio.

Meanwhile, Bluerock Diversified Industrial Portfolio II DST, structured as a hybrid UpREIT, provides investors with the option to either continue holding their DST interest or elect to participate in a REIT conversion at a future date.

These examples highlight the key distinctions between hardwired and hybrid UpREIT structures, demonstrating the strategic considerations investors must weigh when planning their 1031 exchange exit strategy.

| Multifamily DST |

|---|

Hines HREX

Multifamily III DST

-

Sponsor Hines

-

Property Type Multifamily

-

Location California

-

Properties 1 Property

-

Units 249 Units

-

Offering Size $128,620,090

-

Equity Offering $128,620,090

-

Loan-to-Value 0%

-

First Year Cash Flow See PPM

Hines HREX Multifamily III DST is a mixed-use residential, office and retail property located in San Jose, California. Built in 2021, Diridon West is a 7-story mid-rise building comprised of 249 residential units and over 26,000 square feet of ground floor commercial office / retail space. The residential units are currently 95.6% occupied and offer a diverse mix of studio, 1- and 2-bedroom floor plans ranging on average from 454 – 1,299 square feet. Residents of Diridon West have easy access to air travel, as the property is less than four miles from the San Jose Mineta International Airport. Residents also have access to several entertainment, retail and grocery options within walking distance, including Whole Foods, Trader Joe’s, Sprouts Farmers Market, Target and World Market.

Hines is a fully integrated real estate investment and management firm with a 65-year history of investing in real estate assets and delivering services in acquisition, development, financing, property management, leasing, and disposition. With a presence in 285 cities across 28 countries, Hines employs approximately 4,800 people worldwide, with its headquarters in Houston.

| Industrial |

|---|

Bluerock Diversified

Industrial Portfolio II DST

-

Sponsor Bluerock Value Exchange

-

Property Type Industrial

-

Location North Carolina

-

Properties 3 Properties

-

Units N/A

-

Offering Size $54,910,038

-

Equity Offering $54,910,038

-

Loan-to-Value 0%

-

First Year Cash Flow See PPM

Bluerock Value Exchange is a national sponsor of syndicated 1031 exchange offerings with a focus on Class A assets that can deliver stable cash flows and have the potential for value creation. Bluerock’s senior management team has an average of over 29 years of investing experience and has helped launch leading real estate private and public company platforms.

Bluerock Diversified Industrial Portfolio II DST consists of three industrial properties located in North Carolina. The portfolio is nearly 90% leased and combines to provide approximately 424,000 square feet of logistics warehouse space currently leased to five tenants. The weighted average remaining lease term is approximately 4.06 years. Tenants include Mac Papers and Packaging, Central Aluminum Supply, Yale Industrial, FedEx and Amazon.

721 UpREIT Case Study

Background and Investment Strategy

Elizabeth, a retiring owner of multiple rental properties, wanted a more efficient way to pass her properties to her beneficiaries. She also sought to reduce the burdens of direct property management while benefiting from passive income and tax deferral. Her long-term goal was to transition her holdings into REIT shares to simplify estate planning and eliminate management responsibilities.

1031 Exchange into DST Properties

Elizabeth performed several 1031 Exchanges to defer the capital gains taxes on her real estate sales. She reinvested the proceeds in Delaware Statutory Trust (DST) properties, which provided fractional ownership of institutional-grade assets. By doing so, she eliminated the need for hands-on property management while continuing to defer taxes.

DST Absorption into a REIT

After several years, the DST properties in which Elizabeth had invested were absorbed into REITs via the 721 UpREIT process. Elizabeth’s fractional interests in the DSTs were exchanged for Operating Partnership (OP) units in the REITs, allowing her to continue to defer her capital gains tax. The OP units provided Elizabeth with passive income through dividends distributed from the REIT’s operations.

Estate Planning and Beneficiary Benefits

Upon Elizabeth’s passing, her beneficiaries inherited the OP units, which benefited from a step-up in basis to fair market value. The step-up eliminated the deferred capital gains tax. OP units were easily divided among the heirs. With the tax liability eliminated, the beneficiaries converted their OP units to REIT shares. At which time each beneficiary could independently decide whether they wanted to liquidate their inherited shares with no tax consequences or continue to hold them for passive income and future appreciation potential. The flexibility and liquidity offered by the REIT structure ensured a smooth estate transition, fulfilling Elizabeth’s estate planning objectives.

721 Exchange FAQs

A 721 UpREIT includes the absorption of investment real estate into a larger portfolio with ownership of the larger portfolio (Operating Partnership Units) provided as consideration to the owners of the absorbed property on a tax deferred basis. A 1031 Exchange enables the sale and exchange of like-kind property (including DSTs) on a tax deferred basis.

UpREITs are designed for accredited investors who meet specific financial criteria, suitability standards, and have the requisite financial acumen to understand the investments.

Accredited investors are individuals with a net worth exceeding $1 million, excluding the value of their primary residence, or those with an annual income over $200,000 (or $300,000 for joint income) for the last two years with the expectation of earning the same or higher income in the current year.

Exiting an UpREIT involves converting OP units into REIT shares, which can be sold on the open market. However, the conversion and subsequent sale may trigger tax implications that should be carefully considered.

The primary tax benefit of a 721 UpREIT transaction is the deferral of capital gain tax on the conversion of real estate for OP units. However, eventual conversion of these units to REIT shares or other dispositions may result in a tax liability if occurring before a stepped-up basis is realized and at a value beyond the carryover basis of the ownership.

Evaluating a 721 UpREIT’s suitability involves assessing your investment goals, liquidity needs, tax considerations, and appetite for diversification. Consulting with an Exchange Advisor is crucial to navigate these considerations.

721 UpREIT opportunities are typically provided through companies specializing in real estate investments. The licensed Exchange Advisors at Real Estate Transition Solutions (RETS) can help you find 721 Exchange opportunities.

REIT Investment Basics

How REITS work

Real Estate Investment Trusts (REITs) allow investors to own shares in a diversified portfolio of large, income-producing properties. Established by Congress in 1960, REITs enable smaller investors to access institutional-grade real estate without directly owning or managing properties.

- A REIT functions as a trust structure that receives preferential tax treatment. To qualify as a REIT, it must meet specific criteria, such as:

- A minimum of 75% of assets must be in real estate

- A requirement to distribute at least 90% of taxable income to investors

- Income must primarily come from property rents or the sale of properties

The pooled capital from multiple investors enable REITs to acquire and manage large property portfolios. In return, the REIT distributes rental income to its investors, offers access to potential appreciation of underlying assets, and provides tax sheltering through depreciation and the Qualified Business Income (QBI) deduction.

Unlike traditional corporations, REITs are pass-through entities, meaning they do not pay corporate income tax. Instead, the income flows directly to the investors, who pay tax at their individual income tax rates.

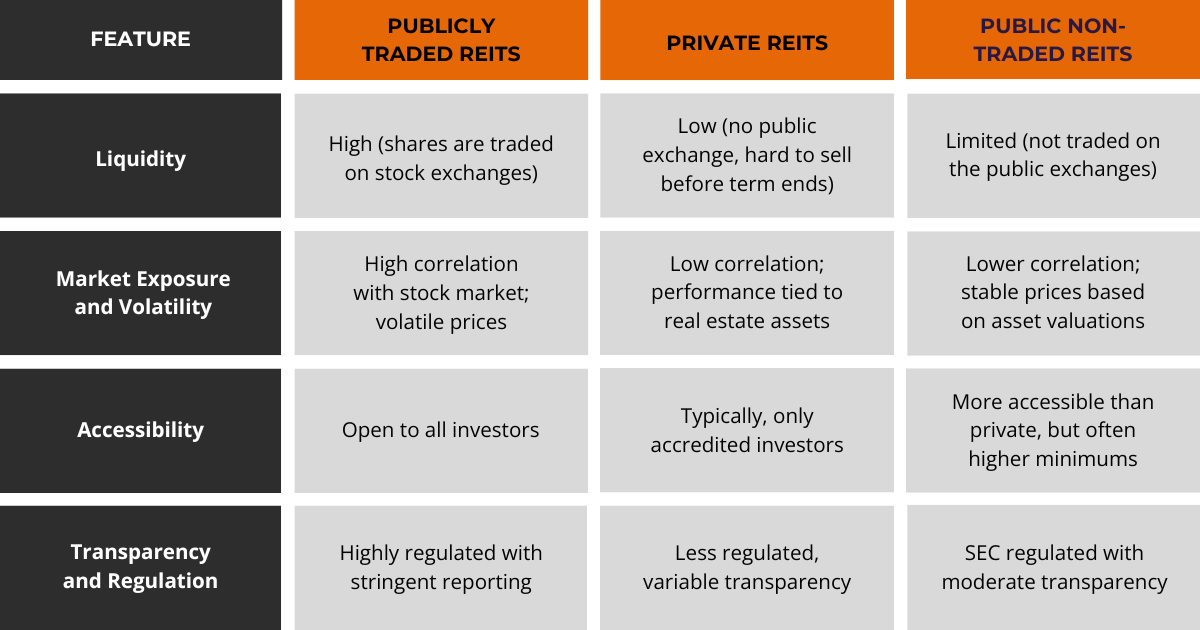

REIT Market Types

REITs are categorized based on how they are traded and the liquidity they offer:

- Publicly Traded REITs: Listed on major stock exchanges, these REITs offer maximum liquidity. Share prices fluctuate with the market, and investors can buy or sell shares with ease.

- Private REITs: Not listed on exchanges and usually with a defined investment duration, private REITs offer limited to no liquidity. Investors typically must wait for the REIT to sell assets before realizing returns beyond dividend distributions.

- Public Non-Traded REITs: These are regulated by the SEC but are not listed on stock exchanges, making them less liquid than publicly traded REITs. Share prices are determined through periodic appraisals rather than market-driven pricing and share sales are subject to liquidity or redemption programs set forth by the REIT.

REIT Investment Types

REITs can be classified by their underlying assets and the ways they generate income. Here are the three main types:

- Equity REITs: These own and operate income-producing real estate (e.g. multifamily properties, industrial properties, self-storage facilities, shopping centers, etc.). Investors realize returns through rental income and property value appreciation.

- Debt REITs: Also known as mortgage REITs, these REITs invest in real estate debt, such as mortgages or mortgage-backed securities. Investors earn returns primarily through interest income.

- Hybrid REITs: These combine aspects of both equity and debt REITs. Hybrid REITs own income-generating properties while also investing in real estate debt related investments. This dual approach provides diverse income streams for investors.

REIT Sector Focus

Equity REITs are further categorized by the types of property in which they invest, with each property type offering unique opportunities and risks. Here are some of the property types REITs focus on:

- Residential: Multifamily apartment buildings, SFRs, and housing communities

- Retail: Shopping malls, grocery-anchored retail centers, and standalone retail locations

- Industrial: Warehouses, distribution centers, and logistics hubs

- Healthcare: Medical facilities, hospitals, and skilled-nursing homes

- Data Centers: Server farms, data centers and various digital infrastructure properties

- Self-Storage: Self-storage and commercial storage facilities

- Office: Single-tenant office, multi-tenant office, office parks and government leased office primarily in urban and suburban markets

- Diversified: Offering a blend of various property types within the portfolio

These diverse sectors enable investors to choose REITs that align with their investment goals, whether they seek stability, growth, or sector-specific exposure.

REIT Pros and Cons

Pros of Investing in REITs

- Diversification: REITs provide exposure to a wide range of property sectors and geographic markets, both domestic and abroad

- Passive Income: REITs distribute dividends to investors, often with tax advantages

- Tax Efficiency: Depreciation and Qualified Business Income (QBI) deductions can reduce taxable income

Considerations for Investing in REITs

- Limited Control: REIT investors do not control day-to-day management decisions

- Volatility: Publicly traded REIT shares can fluctuate with the broader stock market

- Dividend Taxation: Dividends, less deductions, are often taxed as ordinary income

- Fees: Management fees can reduce net returns

About Real Estate Transition Solutions

Real Estate Transition Solutions (RETS) is a consulting firm specializing in tax-deferred 1031 Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about 1031 Exchanges and Real Estate Transition Solutions, visit re-transition.com or call us at 888-755-8595.

Austin Bowlin, CPA is a Partner at Real Estate Transition Solutions (RETS), a national real estate investment advisory firm specializing in 1031 Exchange strategies and Delaware Statutory Trust investments. As Chief Exchange Strategist, Austin leads the firm’s team of licensed 1031 Exchange advisors and analysts. His work focuses on tax analysis, developing tax-deferral strategies, legal entity re-structuring, co-ownership arrangements, 1031 replacement property options, and Delaware Statutory Trust investments.